Harrington Group Blog

Running a nonprofit organization differs from running a for profit organization in many ways. One of these distinct differences is the importance of transparency from nonprofit organizations. Both audits and reviews are a way to provide a third-party analysis of your organization’s finances, therefore achieving this required transparency. More often than not, audits are a requirement for funding (although there are times you may be able to get away with a review).

Although audits and reviews are very similar, they do have some key differences. So, how do you decide which option is best for your organization? The answer will depend on the size of your organization, the resources that you have available and what kind of funding you receive.

Let’s look at some key differences between audits and reviews:

1. Cost

Audits are going to be more expensive than reviews (about double the price). This is because they are more comprehensive and time-consuming. An audit may run an organization anywhere between $10K-$20k. This may seem like a big hit but will provide ultimate transparency to your donors, as well as federal and state governments. If your organization has a gross revenue that surpasses $500k, an audit is likely the best choice for you. If you fall below $500k, you may be able to get away with a less expensive review.

Generally, the larger and more complex your organization is, the more likely it is that you will require an audit. It could also be a worthwhile strategy to rotate between audits and reviews on alternating years.

2. Depth

Although audits and reviews are both providing a third-party analysis, an audit is ultimately providing a more in-depth analysis. The auditor provides an expert level deep dive into your documentation and finances. They conduct extensive research and testing, providing the highest level of assurance. Basically, they leave no stone unturned. On the other hand, a reviewer will only analyze a certain percentage of documents. They may be able to identify some problem areas but overall, they are not identifying a full scope of red flags nor are they extensively testing your financial controls.

3. Additional Services

Audits, unlike reviews, often include a number of additional services. An auditor will go the extra mile in order to develop an understanding of your organization’s internal control environment. The additional services include walk-throughs of your office space, physical inspections and observations. They will also confirm balances and transactions with outside parties, unearthing an additional layer of transparency. In addition, auditors will conduct tests wherever they deem necessary. Reviews do not include any of these additional services.

Conclusion

In order to determine whether your organization would be better suited for an audit or for a review, make sure to take these key differences into account. You will need to assess your reasoning for an audit/review, the size and complexity of your organization, your budget and your unique internal environment. If you feel that an audit is a requirement for your specific type of funding, know that you can at least inquire to see if a review would be acceptable (even if just on a bi-annual basis).

So, the Holidays have arrived. Thanksgiving is here, which means Black Friday and Cyber Monday are creeping around the corner. With the added challenges of 2020, Cyber Monday is sure to blow black Friday out of the water this year. I’m sure you’ve already got a slew of advertisements crowding your e-mail inbox and that you’re being bombarded by side bar marketing highlighting all of the % off deals.

For anyone who is trying to responsibly manage their finances, for those who may have been financially impacted due to the pandemic or even for those who are trying to reduce their clutter, the excess of sales can be an unwelcomed temptation. Buying anything simply for the fact that it’s a “great deal” isn’t a good reason to be buying it. This is not responsible budgeting. However, taking advantage of the opportunity to buy something (that you have good reason to be purchasing) at a discounted rate, as opposed to full price, is saving money! This is the determining factor when deciding if your purchase was an impulse buy or a strategic buy.

Our advice to you, is that you stick to strategic buys this Cyber Monday, if you plan to participate in the discounts and deals. To help you achieve that healthy budgeting guideline, we have compiled some tips to avoid impulse shopping on Cyber Monday:

1. Make a Shopping List

Pretty straight forward, right? If you go in with a plan, you will be able to refer to your list every time you have to question yourself. To the question “Is this an impulse purchase?” you should be telling yourself “Yes”, if it’s not on your list.

Make your list as specific or as vague as you like, as long as it includes all the types of purchasing that you set out to do. For example, you can just add a line item that says “Christmas gift for Dad”, instead of specifying what the gift will actually be.

2. Create a Budget

It can be easy to get sucked into deals, especially when there are web banners from your favorite stores telling you that if you spend $200, you get $50 off….buy one, get one free…free shipping on all orders over $100…ect ect ect. You may end up spending more money than you set out to just over the thrill of snagging that deal. This is why a budget is helpful. If you have a projected amount that you want to spend, writing that number down ahead of time will help you control your purchasing.

3. Replenish your Staples

To get the most out of Cyber Monday deals, you must plan ahead. Think about items that you will always need (AKA your staples) and try to avoid purchasing them throughout the year. Use Cyber Monday as your opportunity to replenish these items. Some examples include socks, underwear, bras, plain tank tops or t-shirts, boxers, jeans and even towels or linens. Using these deals to your advantage, will ultimately save you money because replenishing your staples throughout the year at full price is more expensive.

Not only is this strategy saving you money, it’s also giving you that satisfaction of shopping on Cyber Monday and you don’t have to fight off the urge to spend money. You are simply channeling that into strategic purchases. Healthy budgeting!

4. Fill Your Shopping Cart and Leave it

Online shopping can be addicting, and you inevitably start to fawn over all of the options of things you can buy with the click of a button. It can be easy to drop items into your cart that catch your eye…but that you don’t really need. Even having a budget doesn’t always keep you in check. A further step of accountability that you can take to avoid impulse purchases is to “walk away” from your shopping cart and come back to it later. These days, Cyber Monday deals are running for multiple days and up to a week or more. So, you will not miss out on savings by taking a break to think about it.

Sometimes, when you come back to that cart after the rush of shopping dopamine has settled, you will notice there are some items that you can probably do without. Do a quick edit and then move forward!

5. Create a Buddy System

Having a friend or family member give you their opinion before you click that “place order” button can help you avoid some unnecessary purchasing. The people closest to you in your life will know you the best and therefore their opinions may be insightful. If you are about to purchase $250 worth of clothes and your best friend points out that you already bought new clothes recently, that your closet is too full and that you always talk about wanting to save money…you may be able to take a step back and think twice about spending that money. On the other hand, if you’re buying $150 worth of staples, that would have otherwise cost you $300-$400 throughout the year, having your best friend affirm that this is a good use of money will make you feel even more validated to go through with it.

Conclusion

All in all, we want you to make the most of your money and create healthy budgeting habits. Living beyond your means, due in part to the allure of materialism and the addiction of impulse purchasing, can easily put you into a cycle of debt. Debt causes stress and stress impacts your life in many unfortunate ways. You CAN walk the path of a debt free lifestyle, where you are financially free and independent! It starts with strategic Cyber Monday shopping (if any at all).

2020 is a year that has brought about a lot of changes and they just keeping coming. Beginning this year, the IRS has split the 1099 tax form into two separate forms: Form 1099-NEC and Form 1099-MISC (because we all needed another tax form added to the list). Let’s break down the differences, as outlined on the IRS website, so that you can be prepared for the upcoming tax season:

Form 1099-NEC

This form is for reporting N(on) E(employee) C(ompensation). If your organization has paid out at least $600 or more in compensation for services to a nonemployee (such as an independent contractor), in fees or in commissions, then you may be required to file a 1099-NEC form. There are four conditions, outlined by the IRS, that constitute the filing of a 1099-NEC. If you meet the following conditions, then you should be prepared to file this new form during this upcoming tax season. The form will be due to the IRS, as well as the recipient, by February 1, 2021.

1. You made the payment(s) to a nonemployee

2. You made the payment(s) for services (not merchandise or other)

3. You made the payment(s) to an individual, partnership or other unincorporated entity

4. You made the payment(s) to a recipient totaling at least $600 or more during the tax year

Remember, if payment(s) for these conditions do not total at least $600, you generally do not need to file a Form 1099-NEC.

Form 1099-MISC

This form is aimed at all other miscellaneous service payments (OTHER than nonemployee compensation). The IRS outlines the following conditions, which indicate that payments should be reported on the Form 1099-MISC:

1. Payments of at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest

2. Payments of at least $600 or more in the following categories:

a. Rents

b. Prizes and awards

c. Other income payments

d. Cash paid from a notional principal contract to an individual, partnership, or estate

e. Fishing boat proceeds

f. Certain medical and health care payments

g. Crop insurance proceeds

h. Payments to an attorney (other than fees for services)

i. Section 409A deferrals

j. Nonqualified deferred compensation

The Form 1099-MISC is also due to the recipient by February 1, 2021 but not due to the IRS until March 1, 2021 (for paper filing) or March 31, 2021 (for electronic filing).

CONCLUSION

It’s important to make sure you are aware of these changes, in order to ensure correct filing of your organization’s 2020 tax documents. Be sure to request a W-9 from your independent contractors and service providers ahead of tax season. You may even request this form upon hiring them for work. This will ensure that you have all their necessary tax information in case you need to file a 1099 for their services. Pay attention to all filing deadlines and reporting requirements for this new form change.

A Virtual Office

Working from home is an isolating experience and can be a drastic transition for those who are used to commuting to an office building 5 days a week. Ensuring that employees do not fully lose the social aspect of an office environment is key in keeping your staff engaged. Investing in the best video conferencing and collaboration tools will give you the foundation that you need to facilitate a virtual office.

Using video conferencing, so that everyone can still interact “face-to-face” (even through a screen) will help combat the variety of distractions that come with working from home. It may also give employees the motivation to maintain their morning routines, which include getting dressed and ready for work. Putting on business appropriate attire and getting out of PJs is a mental step into work mode.

Create Opportunities to Socialize

Humans are social creatures and interaction with one another, even virtually, will help to ease the isolating experience of working from home. Once you have established a virtual office environment, you can start to outline some strategies and formats for both teamwork projects and non-work socializing.

Grouping employees together in work pods can be an effective way to facilitate a feeling of teamwork. This also helps to create an internal system of accountability, as members of the same work pod can keep each other on track with completing tasks and keeping the flow of productivity moving forward. You can choose to keep the same pods together or do a monthly rotation to create new pods. As this strategy is meant to relieve the stress of isolation, it would be best to make decisions based on the satisfaction (or lack thereof) of your employees. Try sending out surveys for feedback, which will help you determine if your staff enjoys rotating work pods, keeping the same pod or even if they find the teamwork aspect to be adding more stress and would prefer to work alone.

Encouraging and facilitating opportunity for non-work socializing will also help to ease the pains of isolation. Launching daily video conference “social hangouts” would give employees the opportunity to chat with one another about non-work topics. Think virtual coffee breaks, virtual lunch breaks or virtual post-work happy hours. Every employee can be sent an invitation to join and choose to accept or decline. Mixing in some activities can also add a little excitement. Perhaps you have an employee who would love to lead a lunch time yoga session. There may be a group who is interested in playing virtual games or someone who would love to host virtual karaoke. This would be another great opportunity to survey the office! Having a forum where employees can all post and talk to one another, will allow ideas to flow and help to keep everyone engaged with one another.

Friendly Competition

Employee of the month might be a little overdone (or not?) but the concept has a strong foundation. A little friendly competition can keep things exciting and positive recognition for the winners acts as a morale booster. I mean, who doesn’t love games??

If you have chosen to group employees into work pods, you can create a pod verses pod monthly challenge. The winners get some sort of prize or incentive. This is a page taken straight from psychological analysis and the “Incentive Theory of Motivation”, which suggests that behavior is best motivated through reinforcement or incentives, in this case positive incentives. The game or challenge can be work related, or non-work related. You can also do an every man for himself challenge, or allow employees to choose teams or a teammate.

Most work from home employees, experiencing loneliness and isolation, suffer from the sheer monotony of living the same day over and over. Ultimately, engaging their brains and peaking the interest of your staff, will increase their energy and focus when it’s time to get back to work. Giving them this variation will help to keep them from falling into a slump of low-energy, which decreases productivity.

Managerial Support

Due to the fact that every home situation is different, it is crucial to ensure that your staff has the freedom to speak up to a manager, should they feel the need. Whether its personal or professional, it is in your best interest to support your employees during this unexpected shift in work/life balance. HR is of the utmost importance.

This support system should also include technological support. Not all staff members will have the same home set up, WIFI capabilities or proper equipment to carry on with their expected quality of work. If this home set up is to fall solely on the shoulders of each employee, they may not have the financial means to acquire the necessary tools. It would be wise to take direct interest in the home office of each employee, whether that means sending them equipment, fully compensating them or partially compensating them, it could mean the difference in overall productivity.

Conclusion

The fact of the matter is that we have been thrown into an unexpected challenge, forced to adjust the way we conduct business and have been given no timeline for return to normalcy. The experience of working from home is a new experience for many people who have been shifted over from office buildings. Many people may not have chosen office jobs, if they previously knew it would mean working from home every day. This puts pressure on employers and organizations to step up and make it more enjoyable, for the sake of employee retention and overall happiness of staff members.

Keep your employees engaged through an increased focus on internal socializing, some friendly competition and an open doors policy on managerial support.

Vilitati Bikai was a beloved manager at Harrington Group, as well as a cherished husband, father, son, and friend. His recent and unexpected passing sent a ripple effect of sorrow throughout our team and we are still searching for our footing, as to how we will move forward, lacking his presence.

Vilitati was an exceptional man who became the light of every room that he entered, spreading kindness and cultivating genuine connections. His trademark smile, coupled with his humble demeanor, made Vili (for short) a magnet for friendships and uplifting conversations. His presence in our offices, in his family and among his friend group will be greatly missed and is irreplaceable.

In remembering our dearest Vilitati, we are honored to share some words from those who were closest to him. His father, Simione Bikai, shared with us that Vilitati “was a very humble and obedient child during his young days. He was a very good and intent listener and a meticulous follower of instructions.” “He was always hardworking, in all areas of life”. This description captures many of the qualities that made him such an impactful part of the Harrington Group team. His strong communication skills were a constant asset to both clients and fellow employees. His work ethic shone through in every task that he took on, as he worked hard to ensure that all his clients were served well, which consistently upheld his reputation of being both trustworthy and reliable. Vilitati was known to strive for nothing short of excellence and for going above and beyond what was expected of him.

His life-long friend Fr. Leronio Vodivodi, who knew Vilitati for over 30 years, described him as “a leader who consistently looked out for others”, explaining that he was “his brother’s keeper”. This is the Vilitati that we know and love. The big brother of our Harrington Group family, constantly looking out for our team, our clients and truly for any being with whom he could make a connection. Vilitati welcomed you with his heart-warming smile and truly embodied everything we cherish about the nonprofit community.

Inoke Qarau, who works alongside Vilitati’s father Simione as one of the Fijian representatives on the Pacific Islanders Study Committee of the United Methodist Church, a cause very near and dear to the Bikai family, migrated to the United States from the Fiji Islands. Inoke explains that the committee was tasked with the study and writing of a comprehensive plan of the Pacific Islanders community nationwide, in which “Vilitati assisted in logistics to begin his selfless and unrivaled service to the community, until his untimely passing”.

Vilitati’s commitment to his community is clear. This is a big reason why he thrived as an accountant in the nonprofit sector, as a teammate, as a family member and as an overall compassionate human being. Vili put others before himself.

Vilitati was heavily involved with his church and with the community at large. To give an idea of the scope of his commitment to the service of others, as well as his overall work ethic, we would like to share a glimpse of his service here:

Church

• Steward & Treasurer of Palo Alto United Methodist Church Fijian Ministry

• Treasurer of the Fijian Caucus of the United Methodist Church of the California & Nevada Annual Conference

• Treasurer of the Fijian National Caucus of the United Methodist Church

• Treasurer of the Pacific Islanders Ministry of the United Methodist Church of the California & Nevada Annual Conference

• Treasurer of the First Fijian Fellowship of the United Methodist Church Inc. (Youth Ministry)

• Served as a Board of Trustees member of the California & Nevada Annual Conference

• Advisor to Fijian communities of faith as they explored ways of legitimizing their fellowship (forming 501C3 status) or acquiring properties

Community

• Treasurer of the Province of Tailevu USA, Inc. (scholarship program for tertiary education in Fiji that began in 2013 with 25 helped and 5 graduates, and awarded $110K FJD in scholarships)

• Treasurer of Home Island of Gau USA.

• Financial advisor to various community groups and alumni organizations (Marist Brothers High School Alumni, Duavata Club, etc.)

Words cannot truly explain what a special person Vilitati was, nor can they accurately convey the deep loss that is felt without his presence. He was a man who wore many hats and impacted many lives in positive ways. He is an ongoing inspiration for those in the nonprofit community, for members of our team and for his own circle of loved ones. Although we cannot physically work with him anymore, his spirit will live on within our company, as we will always remember to strive for the same level of excellence that Vilitati pushed himself towards day to day.

Our deepest love to Vilitati Bikai,

The Harrington Group Family

It takes many moving parts to get a Nonprofit Organization up and running (and to keep it running!). Included on this list of integral parts is a Board of Directors. Appointing board members for a nonprofit is a non-negotiable requirement for operation of the organization. Although it is not difficult to assemble a group of bodies, there should be a level of thoughtfulness that goes into the selection process.

How do you decide which individuals should comprise the board of directors? How many members should it include? What qualifications should you be looking out for? Although there is no one right answer to this scenario, there are some key points that should be taken into consideration.

Diverse Backgrounds of Experience

Assembling a diverse group of individuals, with varying degrees of experience, is an important strategy when appointing a board of directors. Members of the board do not need to specialize in the same industry as your nonprofit is operating within. It is more beneficial to seek out members with diverse professional backgrounds, that differ from both you and others involved in the organization. You may want to consider what skills and/or knowledge are lacking and seek out members to round out those areas.

Keep in mind that candidates with managerial expertise, former executives and business gurus who have learned how to grow companies are invaluable, even if they lack knowledge of your specific industry. The same goes for retired legal attorneys, former human resources experts or marketing professionals.

Also consider mixing up the ages of your members. Older members will have more field and life experience, but younger generations will bring a fresh perspective. The world is constantly changing the rules of business. Marketing and fundraising were vastly different 10-15 years ago than they are now. Younger generations will (most likely) have more experience with social media platforms and building an online presence.

Diverse! Diverse! Diverse!

Teamwork

Although boards won’t be meeting everyday (or even every week), it is crucial to fill these spots with members who will work together to achieve a common goal. They must collectively have the best interest of the organization in mind, while also being flexible enough to bend to the opinions of the other members. You don’t want to end up with stale mates during decision making processes and you don’t want to have any members who are so strong minded that they either overpower the collective and/or drive others away.

Teamwork will be especially important when appointing a diverse board (as you should). With many different backgrounds and areas of experience merging together, there will need to be cohesion between varying opinions and ideas.

Vision and Mission Statements

Another key point to keep in mind when compiling your board of directors, is to ensure that members are aligned with the vision and mission statements of your nonprofit organization. Be clear about the role that your board of directors will need to play within the organization and do so up front. Setting board expectations before assembling the actual board, will help to ensure that selected members will be set up to achieve said expectations. This will help to weed out any candidates who may be thinking that sitting on a board is a stagnant position. Incomers will understand that they must be active in aiding the organization to achieve goals and remain aligned with the vision and mission statements.

Quality Over Quantity

Having too many “cooks in the kitchen” is usually not a good thing. Although you don’t want your board to be too small, you also don’t want it to feel too stuffed. Choosing quality members, with professional expertise and a commitment to the organization, is much better than having a larger group with possible dead weight.

Having said that, there is a minimum requirement of board members that nonprofit organizations have to reach. This minimum depends on the corporate law of the state where the nonprofit was incorporated, but the average number is three.

Additional Tip: Try staggering the terms of your board members. This way, as seats are turned over and new members are onboarding, it will only happen one member at a time. Experienced members will be able to help new members get acquainted.

Let’s Summarize…

A Board of Directors is much like the government of a Nonprofit Organization. They brainstorm ideas, vote on high priority issues and decisions and they should collectively work with the best interests of the organization in mind. The board should contain members of diverse professional backgrounds with varying degrees of skill, whom are capable of effective teamwork and have good ethics.

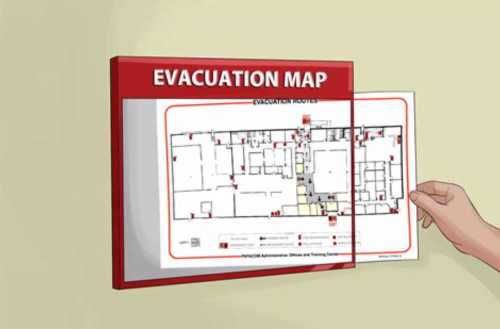

When it comes to emergency situations, the best plan of attack is to be well prepared. Having a solid emergency plan for your business is critical for the safety of employees and customers alike. Emergency procedures should be outlined and communicated to employees well ahead of any potential danger or emergency situation. These procedures should cover both communication between office personnel (in order to minimize chaos during an emergency), as well as evacuation instructions (in order to efficiently vacate the building). It is recommended that your office have an appointed Office Safety Manager, as well as an alternate, in the event that the safety manager is absent. Office Safety Manager can assign specific tasks to other employees (such as grabbing the emergency supply kit, holding doors open for other employees or pulling the fire alarm).

Some key elements in your office emergency plan should include: a PDF document overviewing the office safety procedures (distributed to all employees upon hiring), action checklists to follow during an emergency procedure, as well as a monthly checklist for office safety equipment and supplies.

Let’s look at these categories a little further…

Office Safety Procedures

Upon hiring new employees, each person should receive a PDF overviewing Office Safety Procedures as a part of their new hire entry packet. This document should include a written description of the office emergency plan, outlining procedures for communication as well as evacuation. You may also want to include some or all of the following elements:

• Map of office building (to include locations of emergency exits)

• Location of fire alarm(s)

• Location and quantity of fire extinguishers in the building

• Location of smoke detectors

• Location of first aid kit + office emergency supply kit

• List of (up to date) emergency contact information for each employee and for management/board members– highlight the office safety manager and the alternate

• List of local emergency resources/services and contact information

• Location of rendezvous point to meet after possible building evacuation

Action Emergency Plan Checklist – Evacuation

Clear communication and effective teamwork can lessen potential damage during the onset of an emergency situation. It is paramount to prepare your employees and provide them with a clear plan of action to follow during an emergency. The following checklist can be added to or altered for your specific needs but provides a structure and sequence of steps to follow during an emergency:

• Office Safety Manager to verbally call out situationally appropriate directions during an emergency (directions for a fire will be different than for an earthquake, etc)

• Office Safety Manager (or designated employee) to pull fire alarm (when appropriate)

• Office Safety Manager (or designated employee) to grab emergency supply kit (to include first aid kit) – if able to do so safely and quickly

• All employees to file out of cubicles or office rooms, heading towards closest emergency exits (keep eyes open for fellow employees who may be injured or need help)

• Lightly touch doorknobs before opening, to ensure they aren’t hot from possible fire (when appropriate)

• Ensure to use staircases instead of elevators

• When in doubt, safety of employees and customers is the priority – do not try to find a fire extinguisher to put out a fire, just evacuate the building (unless evacuation is somehow impossible)

• Employees to gather at designated rendezvous point after building evacuation

Once employees have been cleared of the building or moved to safety:

• Office Safety Manager (or designated employee) to take roll call – ensure no one is missing

• Office Safety Manager (or designated employee) to call 911 or appropriate emergency resources

• Office Safety Manager (or designated employee) to assess any possible injuries

• Office Safety Manager (or designated employee) to use contact sheet to contact management or board members who may not be on site, to update them on the current situation

Monthly Safety Checklist + Office Safety Equipment

Every office should be prepared with appropriate safety equipment and supplies. The Office Safety Manager should run through a checklist monthly, in order to ensure safety equipment in working order and supplies are in stock. Every month, check the following:

Equipment/Procedures:

• Fire extinguishers should be in working order, not expired and present in appropriate locations (noted on office map)

• Smoke Detectors have working batteries and are in working order

• Portable defibrillator is charged (in case of cardiac arrest)

• Emergency exit signs are visible and exit passageways are clear of boxes, furniture, etc.

• Safety Training Overview on a quarterly basis (as well as upon hiring new employees)

Supplies:

• First aid kits (with standard medical supplies) are up to date and fully stocked

• Fire blankets are present

• Emergency supply kit is fully stocked and elements are not expired – you can visit http://www.ready.gov/kit to find an overview of a Basic Disaster Supply Kit

Final Overview

The most important part of an office emergency plan is to keep it simple and efficient. Ensure employees are prepared far ahead of any danger and that safety training is revisited on a quarterly basis. The more comfortable officer personnel are with an emergency plan, the more likely that plan is to be executed effectively, efficiently, safely and quickly.

By appointing an Office Safety Manager and designated employees with tasks, you can ensure that the team is working together to get everyone out of harms way. Having clearly defined roles will help to keep everyone is their zone and lessen the possibility of panic.

A well-defined, well-understood and well-practiced office emergency plan is key to risk management and effective emergency management in the workplace.

Does your nonprofit organization reimburse employees or volunteers on the regular? If so, expense reporting may be a sizeable part of your operations. Without a good system for reporting expenses, this process can easily become jumbled and time consuming. It might even leave you with an unwelcomed headache. Don’t worry though, we have some tips to help your nonprofit tighten up this process and create efficiency for expense reporting and reimbursements. Let’s go over a few things…

CREATE CLEAR GUIDELINES

In order to move through this process efficiently, right out of the gates, it is important to have a clear set of guidelines for all of your personnel to follow. An informative PDF with a rundown of expense reporting would be useful to your operations. This PDF should include some key points, which are aimed to clear up questions before they arise and cut down on the time it takes to complete the full process. These key points include the following but feel free to add anything else that feels relevant to your organization:

• A list of expenses that are acceptable for reimbursement

• The reimbursement rate for mileage (driving)

• The form(s) that should be used for expense reporting

• What to do if a receipt is lost?

• Deadlines for expense reporting

• Instructions on filling out forms and/or digitizing the completed forms and receipts

ENFORCE DEADLINES // DON’T PROCRASINATE

When information is fresh in our brains, it is much easier to report without making any mistakes or forgetting where you stashed your receipts. Having clearly defined deadlines for expense reporting is a key tool in keeping your personnel on track. If expenses are not submitted within the established timeframe, employees and volunteers should understand that they will not be reimbursed past this deadline. This will keep everyone sharp and on their toes, keeping all parties involved on track.

CAREFULLY CRAFT DETAILED FORMS

The process of submitting expenses should be fully streamlined, in order to achieve maximum efficiency. Crafting a form for employees or volunteers to fill out and submit, will create cohesion. Lined paper scribbled on with chicken scratch writing at the end of a long workday just won’t cut it. Messy submissions also make the reimbursements more complicated to process and leave a margin for error. So, carefully craft detailed forms for you personnel to fill out when reporting expenses and make sure the form is easily accessible. In general, the form should include: date that the expense was occurred (should match the date of the expense receipt), the reason for the expense spending, the total dollar amount of the expense, the name of the employee or volunteer to whom the reimbursement should be paid and the date that the form was filled out. Depending on your operations, you may also want to include a space for employee and manager signatures and any other internal needs for processing the form (form #, etc). Lastly, make sure that your form includes detailed instructions on how to fill out and submit.

USE TECHNOLOGY // DIGITIZE PROCESSES

In today’s world, there is an application for just about everything. Explore automated solutions that would allow you to upload forms and receipts into a digital portal, creating a quick and easy process for personnel to follow. Digitizing would make expense reporting easier and more efficient from beginning to end. No more crumbled receipts, coffee stained forms or illegible writing. Even without exploring applications, you can include instructions in your detailed form for employees and volunteers to scan receipts into a PDF and send them in along with a scanned reimbursement form. You may also want to give instructions on how an employee should title their form and/ or how an administrative employee should name or rename when filing the report. This will keep digital files orderly and easy to access.

There you have it! Some easy steps to follow that will make your organization a little more organized and your accountant a little happier! All good, all around. Happy expense reporting!!

CREATE CLEAR GUIDELINES

In order to move through this process efficiently, right out of the gates, it is important to have a clear set of guidelines for all of your personnel to follow. An informative PDF with a rundown of expense reporting would be useful to your operations. This PDF should include some key points, which are aimed to clear up questions before they arise and cut down on the time it takes to complete the full process. These key points include the following but feel free to add anything else that feels relevant to your organization:

• A list of expenses that are acceptable for reimbursement

• The reimbursement rate for mileage (driving)

• The form(s) that should be used for expense reporting

• What to do if a receipt is lost?

• Deadlines for expense reporting

• Instructions on filling out forms and/or digitizing the completed forms and receipts

ENFORCE DEADLINES // DON’T PROCRASINATE

When information is fresh in our brains, it is much easier to report without making any mistakes or forgetting where you stashed your receipts. Having clearly defined deadlines for expense reporting is a key tool in keeping your personnel on track. If expenses are not submitted within the established timeframe, employees and volunteers should understand that they will not be reimbursed past this deadline. This will keep everyone sharp and on their toes, keeping all parties involved on track.

CAREFULLY CRAFT DETAILED FORMS

The process of submitting expenses should be fully streamlined, in order to achieve maximum efficiency. Crafting a form for employees or volunteers to fill out and submit, will create cohesion. Lined paper scribbled on with chicken scratch writing at the end of a long workday just won’t cut it. Messy submissions also make the reimbursements more complicated to process and leave a margin for error. So, carefully craft detailed forms for you personnel to fill out when reporting expenses and make sure the form is easily accessible. In general, the form should include: date that the expense was occurred (should match the date of the expense receipt), the reason for the expense spending, the total dollar amount of the expense, the name of the employee or volunteer to whom the reimbursement should be paid and the date that the form was filled out. Depending on your operations, you may also want to include a space for employee and manager signatures and any other internal needs for processing the form (form #, etc). Lastly, make sure that your form includes detailed instructions on how to fill out and submit.

USE TECHNOLOGY // DIGITIZE PROCESSES

In today’s world, there is an application for just about everything. Explore automated solutions that would allow you to upload forms and receipts into a digital portal, creating a quick and easy process for personnel to follow. Digitizing would make expense reporting easier and more efficient from beginning to end. No more crumbled receipts, coffee stained forms or illegible writing. Even without exploring applications, you can include instructions in your detailed form for employees and volunteers to scan receipts into a PDF and send them in along with a scanned reimbursement form. You may also want to give instructions on how an employee should title their form and/ or how an administrative employee should name or rename when filing the report. This will keep digital files orderly and easy to access.

There you have it! Some easy steps to follow that will make your organization a little more organized and your accountant a little happier! All good, all around. Happy expense reporting!!

Whether you’re working from home, running a family household, juggling a job and going to school at the same time, running multiple businesses or just can’t seem to find enough time in the day…it’s all too common to feel like you’re carrying a weight on your shoulders. Modern day life can be overwhelming, to say the least. Tasks seem to stack up quicker than breakfast joint pancakes. Luckily, there are ways to manage! In comes…the TO-DO list. The catch all of your unresolved tasks and projects. The invisible shoulder to cry on when you’re feeling like you don’t know where to start.

Not every approach to list making is effective…if you just write it down and forget about it, spill coffee on it and then accidentally throw it out, write it on a current page of your calendar planner but flip the page next week and leave the unresolved list behind…let’s just say there are some missteps that can stand in your way of productivity. Although not everyone works in the same way, we’ve got some tips for effective list making that are sure to help the average Joe or Jane. Let’s take a look…

Make A List

Okay Okay…this is a pretty obvious place to start but why do lists help? This is an important psychological step to calming your mind. Having all of your tasks floating around in your head contributes largely to the feeling of being overwhelmed. Once you are able to extract them from your cluttered mind and transfer them to a physical list, you can start to focus your attention on completing them, rather than just thinking about them.

The most important part of this step is to make a list that works for YOU. Some will prefer an old school pen and paper method (cute notebook, planner, scrap paper, post-it notes??), others will do better with a digital version (I-Notes, note taking apps, etc) or maybe you’re the type who likes a dry erase board next to your desk.

Personally, I have multiple lists locations. I use a white board marker on my bathroom mirror, so that I am reminded every morning of tasks that I can easily complete that day (there’s something ever so satisfying about erasing as the day goes on). Additionally, I am also an old school pen and paper loving kinda list maker. I carry my little notebook around in my bag, so that I can add to my list whenever I think of something in my head (we all know this can happen at the most random times and if not written down immediately, the idea is likely to slip away again, to return at another unknown time!).

Keep It Updated

It’s important to stay active with your list. Keep it updated by crossing off items that have been completed and adding new items as they come up. Having access to your list when you are out and about will be helpful for this tip, so try to carry your notebook or planner along with you or if you choose a digital version, make sure it is accessible from your phone.

As the days or weeks go on, it is also helpful to evolve your list. Once you have crossed off a good chunk of items, transfer the remaining items to a new list and continue to add to that. This makes the most sense with handwritten lists, as they can get messy as you cross off and jam new items onto the paper.

Roll The Ball With Small Stuff

When you stare at a long list of TO-DOs with nothing checked off, it can feel a little like there’s no end. That’s okay because we can quickly jump over that hurdle by starting with some small and easily achievable tasks. Maybe one of your TO-DOs is to wash the dishes (which you estimate will take 10 minutes), this can be a great place to start. It may seem like something you don’t really need to write on your list, as you will see the dishes in your sink and remember that you need to handle that BUT adding even the smallest of tasks will allow you to cross them off. If you can cross off a handful of short tasks within, say 30 minutes or so, you will start to feel the joys of progress and your motivation to tackle the more time-consuming tasks will increase!

Identify Your Top Priorities

Small tasks are perfect for building up your motivation and feeding your productivity but they aren’t always the most important line items. Every morning try to identify at least 3 of your top priority tasks. Is it tax season? Have you been putting off your bookkeeping? You don’t want to have a false sense of productivity by only checking off small stuff but continuing to avoid the big stuff. A good strategy here is to put some stars next to your high priority tasks. Make sure you are crossing off starred items on a daily or at least regular basis (depending on the length of your list, your schedule and timelines for completion).

It’s normal to procrastinate some of the big stuff. Another strategy that I like to use, is to add upcoming tasks (such as tax prep) to my TO-DO list very far in advance to the deadline that I wish to complete them by. This allows me to procrastinate them, without putting them out of my mind. I know that I won’t forget because it is accounted for but I also know that I have time to put it off…which for some reason feels relieving. By the time this big task becomes top priority, as deadline is approaching, I feel more ready to tackle it, as I have been writing it down on a continuous stream of TO-DOs for months and mentally preparing myself to get it done when the time is right.

Plan Ahead

Having a list is helpful, we’ve established that. Yet, what if you don’t save yourself the time to actually tackle the list? This can be problematic and renders the list mostly ineffective. In order to avoid this, make sure you plan ahead. Whether you have a set 9-5 job or your working hours are more sporadic, choose some time slots that you can spend crossing items off your list. Maybe 30 minutes when you wake up in the morning is a good time to tackle some of the small stuff, to get the ball rolling. Perhaps you can take a lunch break to handle a top priority item and maybe the evening is a good time to check off one or a few more things. Everyone’s schedule is different but if you plan accordingly, you can even set yourself a timer. Whether it’s a 10-minute timer to tidy up your house or a 30-minute timer to work on a more time-consuming task, it will help to keep your mind focused on productivity and allow less distractions to veer you off course.

STAY CALM

Life can be overwhelming but the most important tip I have for you is to stay calm. No matter how expansive your list is or how busy your life is, you will always be more equipped to handle the load when you are cool, calm and collected.

Not every approach to list making is effective…if you just write it down and forget about it, spill coffee on it and then accidentally throw it out, write it on a current page of your calendar planner but flip the page next week and leave the unresolved list behind…let’s just say there are some missteps that can stand in your way of productivity. Although not everyone works in the same way, we’ve got some tips for effective list making that are sure to help the average Joe or Jane. Let’s take a look…

Make A List

Okay Okay…this is a pretty obvious place to start but why do lists help? This is an important psychological step to calming your mind. Having all of your tasks floating around in your head contributes largely to the feeling of being overwhelmed. Once you are able to extract them from your cluttered mind and transfer them to a physical list, you can start to focus your attention on completing them, rather than just thinking about them.

The most important part of this step is to make a list that works for YOU. Some will prefer an old school pen and paper method (cute notebook, planner, scrap paper, post-it notes??), others will do better with a digital version (I-Notes, note taking apps, etc) or maybe you’re the type who likes a dry erase board next to your desk.

Personally, I have multiple lists locations. I use a white board marker on my bathroom mirror, so that I am reminded every morning of tasks that I can easily complete that day (there’s something ever so satisfying about erasing as the day goes on). Additionally, I am also an old school pen and paper loving kinda list maker. I carry my little notebook around in my bag, so that I can add to my list whenever I think of something in my head (we all know this can happen at the most random times and if not written down immediately, the idea is likely to slip away again, to return at another unknown time!).

Keep It Updated

It’s important to stay active with your list. Keep it updated by crossing off items that have been completed and adding new items as they come up. Having access to your list when you are out and about will be helpful for this tip, so try to carry your notebook or planner along with you or if you choose a digital version, make sure it is accessible from your phone.

As the days or weeks go on, it is also helpful to evolve your list. Once you have crossed off a good chunk of items, transfer the remaining items to a new list and continue to add to that. This makes the most sense with handwritten lists, as they can get messy as you cross off and jam new items onto the paper.

Roll The Ball With Small Stuff

When you stare at a long list of TO-DOs with nothing checked off, it can feel a little like there’s no end. That’s okay because we can quickly jump over that hurdle by starting with some small and easily achievable tasks. Maybe one of your TO-DOs is to wash the dishes (which you estimate will take 10 minutes), this can be a great place to start. It may seem like something you don’t really need to write on your list, as you will see the dishes in your sink and remember that you need to handle that BUT adding even the smallest of tasks will allow you to cross them off. If you can cross off a handful of short tasks within, say 30 minutes or so, you will start to feel the joys of progress and your motivation to tackle the more time-consuming tasks will increase!

Identify Your Top Priorities

Small tasks are perfect for building up your motivation and feeding your productivity but they aren’t always the most important line items. Every morning try to identify at least 3 of your top priority tasks. Is it tax season? Have you been putting off your bookkeeping? You don’t want to have a false sense of productivity by only checking off small stuff but continuing to avoid the big stuff. A good strategy here is to put some stars next to your high priority tasks. Make sure you are crossing off starred items on a daily or at least regular basis (depending on the length of your list, your schedule and timelines for completion).

It’s normal to procrastinate some of the big stuff. Another strategy that I like to use, is to add upcoming tasks (such as tax prep) to my TO-DO list very far in advance to the deadline that I wish to complete them by. This allows me to procrastinate them, without putting them out of my mind. I know that I won’t forget because it is accounted for but I also know that I have time to put it off…which for some reason feels relieving. By the time this big task becomes top priority, as deadline is approaching, I feel more ready to tackle it, as I have been writing it down on a continuous stream of TO-DOs for months and mentally preparing myself to get it done when the time is right.

Plan Ahead

Having a list is helpful, we’ve established that. Yet, what if you don’t save yourself the time to actually tackle the list? This can be problematic and renders the list mostly ineffective. In order to avoid this, make sure you plan ahead. Whether you have a set 9-5 job or your working hours are more sporadic, choose some time slots that you can spend crossing items off your list. Maybe 30 minutes when you wake up in the morning is a good time to tackle some of the small stuff, to get the ball rolling. Perhaps you can take a lunch break to handle a top priority item and maybe the evening is a good time to check off one or a few more things. Everyone’s schedule is different but if you plan accordingly, you can even set yourself a timer. Whether it’s a 10-minute timer to tidy up your house or a 30-minute timer to work on a more time-consuming task, it will help to keep your mind focused on productivity and allow less distractions to veer you off course.

STAY CALM

Life can be overwhelming but the most important tip I have for you is to stay calm. No matter how expansive your list is or how busy your life is, you will always be more equipped to handle the load when you are cool, calm and collected.

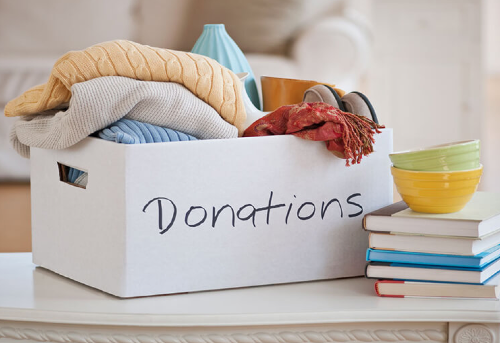

Charitable contributions of all kinds are no doubt the backbone of nonprofit functionality. Can’t go wrong with free stuff, right? Right. Although, the flip side of these contributions definitely involves some extra bookkeeping. As a nonprofit organization you’re required to record and report both cash donations, as well as in-kind donations.

What is an in-kind contribution? The answer is fairly simple, an in-kind contribution is a non-cash gift to a nonprofit. These include the donation of goods, services and even time – that can be used to support the organizations cause. This tidbit will be important in determining whether or not to record certain in-kind donations. Let’s get into a little more detail about the different categories or types of in-kind donations.

Categories Of In-Kind Donations

Goods AKA Tangible Assets

The first type of in-kind donation is arguably the easiest to identify and to record. Donated goods include any type of physical product or supply that you can hold physically touch or hold. These include clothing, food, office supplies, furniture, cars, appliances, equipment, books and more. Items can be new, used or loaned and an organization can choose to utilize the goods or resell them for cash.

Goods are typically the easiest to record because there are many comparisons available when determining the Fair Market Value. For example, if a brand-new appliance was donated, you can check local retailers pricing on the same appliance to reference a Fair Market Value for the item. Similarly, if a used appliance was donated, you can cross reference the value of the used item on a platform such as eBay or Amazon.

What if an item is donated to an organization only to be resold for cash value? For example, a car is donated, and the organization resells this car in a charity auction, for cash. In this instance, the Fair Market value of the item would be determined by the resell price, as opposed to the original selling price of that item.

Furthermore, goods that are unusable shouldn’t be recognized or recorded. This can include expired or rotten foods, clothing damaged beyond wear-ability and outdated vouchers or tickets.

Intangible Assets

This type of in-kind contribution refers to any non-physical item of value donated to the organization, such as advertising, trademarks, royalties, patents and stocks.

Long-Lived Assets

Many nonprofit organizations also receive free or discounted use of office space, buildings, vehicles, equipment, utilities or other long-lived assets. These types of contributions must be donated by the legal owner of the property.

Services

In-kind contributions in the form of services are only important if they enhance non-financial assets or they are services that would have otherwise been purchased. Essentially, in-kind services include those that would help the organization directly or indirectly support its cause. These contributions can be donated by individuals, businesses, corporations, institutions and organizations. Some examples of in-kind services include landscaping, babysitting, accounting, legal, event planning, catering and publishing.

It is only required to recognize and record the services that either create or improve a non-financial asset or that would have otherwise been purchased by the organization. For example,

When determining the Fair Market Value of donated services, you will multiple the going hourly rate for the service by the number of hours donated.

When are you exempt from recording In-Kind Donations?

Volunteer Services

General volunteers, who do not possess any special skills, licenses or certificates related to the work that they are providing, should not be recorded as In-Kind donors. For example, if a lawyer reviews legal documents for free, then this would need to be recorded. If that same lawyer volunteers to hand out water bottles at a charity fundraiser, then that is just good old volunteer services off the books!

Services That Would Have Gone Unpurchased

If a company decides to donate services to your organization, that would not otherwise be purchased, then you do not need to record this. For example, if a professional organizing company offers to organize your office space for free, but you had not planned to spend that money or hire anyone to do this work (before their offer) then this is just volunteer work. On the other hand, if an event planning company offers to help plan a fundraising event, that you would have otherwise hired someone to plan, this should be recorded as an In-Kind contribution.

Just Passing Through

If your organization serves as a type of middle-man, perhaps for donations, then you need not record items that are just passing through. For example, if someone donates a bunch of childrens’ clothes and specifies the desired shelter or program where these clothes are to end up, this would count as just passing through.

| Free forum by Nabble | Edit this page |