Harrington Group Blog

No matter where your business is on its journey, it is now more important than ever to strive for an inclusive workspace for you and your team. Studies have even shown that a more diverse team is a more successful team. When your team feels safe and more uplifted, they will have better results in the workplace and in all aspects of their life. This type of work isn’t always easy but it is well worth the effort.

Below, we will offer up some fun, unconventional ways diversity, equity, and inclusion can be incorporated into your non profit, business, or office.

1. Stock Restrooms with Tampons and Pads

Something as small as this can make the women in your company feel seen and heard. It recognizes the possibility of awkwardness in carrying tampons and/or pads from a desk to the restroom. It shows employees who menstruate that their employer sees this burden, this expense and wants to make their lives easier. If there’s room in your company’s budget for less necessary items, like coffee for example, why not go the extra mile to help female team members out?

2. Purchase Some Diverse Coffee Table Books

On your next restocking of reading material, consider skipping the gossip and fashion magazines. Something short, like a book filled with meaningful quotes, or something lengthier, perhaps a book describing the benefits of DEI in the workplace, can be a great replacement. These reads can go a long way for employees’ mental health and overall balance throughout the workday.

3. Reevaluate Office Artwork

When your office space appears as a gender neutral, it can be more comfortable for all who enter. Sticking to artwork and decor that features nature, abstract shapes, company memories, and architecture is always a safe bet. And lastly, your company decor is a great place to show your team’s diversity. If everyone looks the same in displayed photos, it could definitely be time to switch things up.

4. Spotlight an Employee Weekly

By beginning a weekly employee spotlight on a company website or social media platform, you can really boost company morale. Additionally, you give team members the opportunity to share their stories and background on a potentially larger scale, where they may not have otherwise. Bonus: Clients love to see who they could be potentially working with!

5. Start a Suggestion Box

Feedback is the most effective way to improve anything. Consider the implementation of an anonymous suggestion box within the office. It would be best to place this in a common area, and to provide pens and slips of paper next to the box. The next step is your follow through–employees will both respect and appreciate that you are listening and want to make changes.

6. Host a Book Club

This is the perfect alternative to an after-work happy hour, something that brings folks together, works the brain, and relieves stress. Choose a monthly book about self-development, or inspirational women and people of color. Too time consuming for your line of work? An article or essay club can be just as effective while taking a fraction of the time to read and discuss.

7. Celebrate More Diverse Holidays

Why stop at Christmas? Celebrating Women’s History Month, Hispanic Heritage Month, Black History Month, Pride, and the likes gives your team more reason to celebrate and can make them feel safer and seen in the workplace.

8. Switch Up Team Meetings

By going around the table one by one, it is possible to ask everyone for their ideas. Sticking to a clockwise order and using this technique can avoid interruptions as well as ensure everyone’s voice is being heard. Emphasize that any idea, even if incomplete, is still valuable to bring to the table.

9. Bring a Diversity and Inclusion Speaker into the Office

Looking for a way to engage team members on the topic of diversity, equity, and inclusion? Inviting a guest speaker into the office is the perfect way. Order some food, sit back, and learn how you can improve within your office.

10. Start a Company Blog

Invite employees, especially women and minorities, within your team to contribute to an external-facing, company blog. This can be a space where they can safely share their experiences with prospective clients and employees.

Creating and sustaining a diverse, equitable, and inclusive environment is key to both putting your business on the map and having happy employees.

National Nonprofit Day, August 17th, recognizes the goals and positive impacts nonprofits have on local communities and throughout the world. We are celebrating by supporting and sharing some must-know nonprofits in the Pasadena and Oakland areas.

Here at Harrington Group, we provide auditing, accounting, management consulting, and tax services solely to nonprofit organizations. This, in addition to our partners’ numerous years of experience within the nonprofit sector are just a couple reasons we hold nonprofits near and dear to our hearts. In this blog, we hope to shed some light on some very exciting organizations doing big things for their community.

Oakland

1. Bananas Inc.

This group is serving the youth of Oakland through child care resources, healthcare referrals, workshops, education, and child care payment programs. In targeting kids aged zero to five, parents, and child care providers they hope to fulfill their mission of helping kids be happy, healthy, and confident in their pivotal, developmental years.

Their efforts have led to over 90,000 referrals and other services per year. In addition, Bananas Inc. has been able to provide child care for over 3,500 kids annually. Daily, the organization is advocating for children by fighting for more access to family support services and government-funded child care.

2. Family Violence Appellate Project

This group is dedicated to the safety and empowerment of domestic abuse survivors. FVAP is California’s only nonprofit providing appellate legal representation to survivors for free, helping victims escape the risk of ongoing abuse. Another core component of their mission is to work towards the reshaping of California law, assuring families are kept safe.

In this past year alone, FVAP trained 745 California Attorneys, law students, judges and advocates. In the courts, thirteen domestic violence survivors were represented free of charge, nine cases were published, and 123 domestic violence attorneys were provided with technical assistance pro-bono. This group is doing the work that gets survivors the justice they rightfully deserve.

3. Wardrobe for Opportunity

This organization’s mission is to offer assistance to lower income community members by helping them find, keep, and build a career. WFO is doing this work by offering several different types of resource programs. These include Professional Image Program, Interview Workshops, Navigate, Catapult, Alumni Program and Financial Literacy. Through these programs, WFO is able to assist in the entire job process.

In the past year, the organization served 812 low-income job seekers. Over 60 percent of these folks were able to get an interview, and 43 percent were able to secure a job. By using a start to finish approach, Wardrobe for Opportunity helped in making jobs more accessible than ever to the low-income communities of Northern California.

4. Planet Read

One of the larger of these nonprofits, Planet Read is on a mission to support semi-literates and early-literates by creating accessible SLS, Same Language Subtitling, content. One of their most popular forms of content is their Animated Stories. With regular weekly exposure to these stories, or similar content, a person can become functionally literate.

Planet Read is making literacy both fun and accessible for so many. In 2018, their animated stories reached a whopping 40,000 children. These kids were provided with regular reading practice for free, in the comfort of their homes.

5. Dancin Power

This organization aims to support hospitalized children and their families. They are doing this by enhancing their quality of life with music, dance, and movement-based expression. Dancin Power has Workshops at several children hospitals within the Bay Area. By taking part in these workshops, children are able to better cope with the sadness, fears, and various emotions that come with being hospitalized.

Since its creation, Dancin Power has improved the lives of over 15,000 hospitalized children and families. This movement has been linked to improving recovery time, and preventing further illness due to long periods in bed.

Pasadena

6. Union Station Homelessness Services

This nonprofit is serving the homeless community by putting their focus on permanent solutions: engagement within the community, employment, mental health support services, and of course housing. At their own shelter facilities, the Family Center and the Adult Center, residents are provided with a plethora of resources. These include meals, medical and mental healthcare, substance use recovery programs, career development classes, meetings with a care coordinator, and various enriching activities.

Last year, Union Station Homelessness Services helped over 900 people

experiencing homelessness find permanent housing. Additionally, they served 130,000 meals to those in need.

7. Academy of Special Dreams Foundation

This Foundation is dedicated to creating equal access to opportunities in the arts for all people, regardless of their disabilities. Through their events, they are able to encourage, promote, and showcase the artistic expressions of disabled folks.

Annually, the Academy is actively involved in the Disability Art Exhibit held in Downtown Los Angeles. This exhibit highlights the abilities and talents of artists that are extremely deserving of accolades and support. In their dedication to equality and equity, this group helps all people reach success in the arts.

8. Foundation for Living Beauty

Women with cancer are presented with opportunities to be uplifted, empowered, and educated through Foundation for Living Beauty’s programming. Some of their programs include overnight and day wellness retreats, educational seminars, sisterhood-building events, and providing wellness kits to women in chemotherapy. The challenges this demographic faces through their journey with cancer are extremely complex, but Living Beauty exists to face these head on.

Over 900 women call this nonprofit their home and sisterhood. The staff at Foundation of Living Beauty provide more than forty five wellness programs per year all free of charge for these women.

9. Alisa Ann Ruch Burn Foundation

This group’s mission is to help reduce the number of burn injuries and to improve the quality of life of those affected by burn injuries. Through prevention education in partnership with local schools and local fire departments they are able to effectively meet their goals.

The foundation’s Champ Camp is the longest running and largest summer camp for burn injured children ages 5-16 in the United States. Since their beginnings, they have educated over 15,000 on fire prevention education.

10. Leadership Pasadena

This collaborative organization is dedicated to developing leaders, personal growth, and creating a diverse network of community advocates. In particular, Leadership Pasadena is dedicated to the particular advancement of veterans. They implement their military wisdom to lead and serve their community.

The group has created over thirty community projects for the city, local schools, and charities. Graduates of Leadership Pasadena now sit on over 50 nonprofit boards and even serve as leadership for local government. Their programming has impacted numerous veterans in the Pasadena area.

This National Nonprofit Day, consider donating to a local organization or signing up for a volunteer event near you.

During the summer, we have a tendency to check in on ourselves and our goals as it is a halfway mark through the year. For a lot of us, these goals and manifestations may have been related to finances and money. For others, a goal may have been to hit the books and start reading more. In this blog, we’ll highlight some of the best finance reads for the summer and touch on how financial literature may be a great move for you!

Why read about finance?

Reading about finances is empowering. From it, we learn about wealth creation and investments. This reading can potentially prevent you from making poor financial decisions. As you may have read in our April blog, financial literacy is of the utmost importance. This literacy can have a direct impact on a family’s ability to purchase a home, fund education, manage their budget, and secure a retirement income.

Your attitude about your money is also of the utmost importance. Reading these sorts of books is known to provoke readers to question their current money mindset. The way you spend money is within your control and you absolutely have the ability to change how you look at things.

In addition, reading in general has many great benefits. It is known to improve your general knowledge, focus, and concentration. Reading can reduce stress and depressive thoughts. Who wouldn’t want to be more relaxed and improve their sleep quality?

Book Reccomendations

Feeling ready to get started? Open that Amazon tab or hit the bookstore and prepare to dive in! Below we have some of our favorite financial reads…

1. Quit Like a Millionaire: No Gimmicks, Luck, or Trust Fund Required by Kristy Shen and Bryce Leung

This book runs readers through the new retirement. A great read for millennials and Gen Z, where they can find out how to get to retirement quicker than their family members may have in the past. The authors showcase a new way to look at money and an inspiring, unconventional lifestyle.

2. Rich Dad Poor Dad by Robert T. Kiyosaki

Kiyosaki uses his unique upbringing, one that allowed him to learn two very different approaches to money, to provide readers with knowledge on their financial approach. This book includes lessons on basic accounting knowledge, investing, budgeting, and getting your money to work for you.

3. You are a Badass at Making Money: Master the Mindset of Wealth by Jen Sincero

In this great read, Sincero offers a new look at money, one that focuses on the law of attraction and positive thinking. While she begins unpacking her own financial struggles, readers are able to better relate and put this positivity into practice.

4. The One-Page Financial Plan by Carl Richards

Richards illustrates ideas from his own financial plan and proceeds to show readers how they can do the same. By setting realistic goals and viewing paying debt differently, you can make budgeting both fun and possible.

5. The Millionaire Next Door: The Surprising Secrets of America's Wealthy by Thomas J. Stanley, Ph.D. and William D. Danko, Ph.D.

Consider this book the catalyst to your change in money mindset. These authors examine and breakdown the lifestyle and habits of millionaires. Readers will come to find, this lifestyle isn’t what we typically associate with “the rich”.

6. Think and Grow Rich, a publication of the Napolean Hill Foundation

This interesting read is the blueprint for a wealthy mindset. While it is almost a century old, this book has so much applicable advice for current day finances. The author’s goal is for readers to see the direct results of being determined to succeed and become rich.

7. The Intelligent Investor by Benjamin Graham

Warren Buffett, American business magnate, investor, and philanthropist, calls this the greatest book on investing. The book features Benjamin Graham’s teachings, what Buffett studied in his younger years. Read this book to master the three principles of intelligent investing, analyze for the long term, protect yourself from losses, and don’t go for crazy profits.

8. Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones by James Clear

Making great habits a part of your life will not only help you financially, but in any facet of your life. This is a great read for someone really working towards wealth-building and financial success. Understanding how to form these habits can help you get the results you’ve been looking for and change the way you think about money.

9. The Little Book That Beats The Market by Joel Greenblatt

The author of this book is known to be a bit of an investing legend. This read features a specific, hassle-free investment approach that can be updated and passed down for generations to come. This little book provides readers with the tools they need to succeed in the investment process, with patience being right at the top.

10. I Will Teach You to be Rich, Second Edition: No Guilt. No Excuses. No BS. Just a 6-Week Program That Works by Ramit Sethi

This book is modern and perfectly structured for millennials and young generations looking to change their money mindsets. Sethi shows readers how to make wealth building easy, by adjusting it to be done automatically. This is a great read for anyone who has motivation regarding their money, but doesn’t know where to begin.

We hope these reads provide some food for thought in these summer months. Happy Reading!

With summer in full effect, you and your family may have an abundance of free time on your hands. What’s the perfect way to have fun in the sun, listen to live music, support local businesses, and have a positive impact on the environment? The Farmer’s market, of course!

In this blog, we’ll touch on the benefits of shopping at your local farmers market and of course, plug our neighbors. As you may know by now, our offices are located in Oakland and Pasadena, CA, both cities with great markets to offer you and your family this summer!

Why shop at a farmers market?

A big reason someone might choose to shop at the farmer’s market is for something as simple as the taste. Unlike the produce we see in our local grocery store, these fruits and vegetables are able to fully ripen in the field, skipping a very common practice of simulating the ripening process. Additionally, the produce is brought directly to you–bypassing the usual long haul and placement in storage. These two factors alone can dramatically impact the taste of your fruits and veggies. It's these same transportation and distribution techniques that can cause us to take our food for granted. Seeing these farmers and their families can help you to feel connected to where your food comes from.

The sellers at these marketplaces are family farmers in need of support as they may be struggling to keep up with the competition–large scale, corporate-ran farms. Buying directly from these farmers also gives them a chance at a larger return for their work and investment.

On average, food travels 1,500 miles to end up on our plates here in the U.S. This transportation has a huge impact on our fossil fuel issue, contributing to pollution and excess trash through packaging techniques. Shopping at your local farmer’s market can help to protect the environment.

What produce is in season?

Another great part of the farmer’s market is the variety! It is very common to see your produce in new colors you may have never seen at the grocery store. There are also some more uncommon types of produce available as well. When shopping for produce, a great way to maximize taste, freshness, and nutrition is by consuming foods that are in season. Some items in season right now in California are…

-Apples

-Asparagus

-Basil

-Berries

-Green Beans

-Lemongrass

-Melons

-Peaches

-Plums

Now, where to shop?

Pasadena:

Villa Parke Center Pasadena Farmers Market

When: Tuesday, 8:30 am – 12:30 pm

Where: 363 East Villa Street, Pasadena, CA

Victory Park Pasadena’s Farmers Market

When: Saturday, 8:30 am – 12:30 pm

Where: The 2900 Block of North Sierra Madre Boulevard, Pasadena, CA

Old Pasadena Certified Farmers Market

When: Sunday, 9:00 am – 2:00 pm

Where: Holly Street at Fair Oaks Avenue, Pasadena, CA

South Pasadena Farmers Market

When: Thursday, 4:00 pm – 8:00 pm

Where: On Meridian Ave and El Centro Street next to the Gold Line South Pasadena Station, South Pasadena, CA

Oakland:

Fridays in Old Oakland

When: Friday, 8:00 am - 2:00 pm

Where: Oakland's Downtown District; 9th Street at Broadway

Farmers Market at Lake Merritt/Grand Lake

When: Saturday, 9:00 am – 2:00 pm

Where: Splash Pad Park, Oakland, 94610

Temescal Farmers Market

When: Sunday, 9:00 am - 1:00 pm

Where: North Oakland DMV 5300 Claremont Ave, Oakland, CA 94618. Adjacent to Frog Park

Freedom Farmers' Market North Oakland

When: Saturday, 9:00 am - 2:00 pm

Where: 4521 Telegraph Ave, Oakland

On your next free weekend, be sure to check out one of these open-air markets. Here’s to great food and great taste!

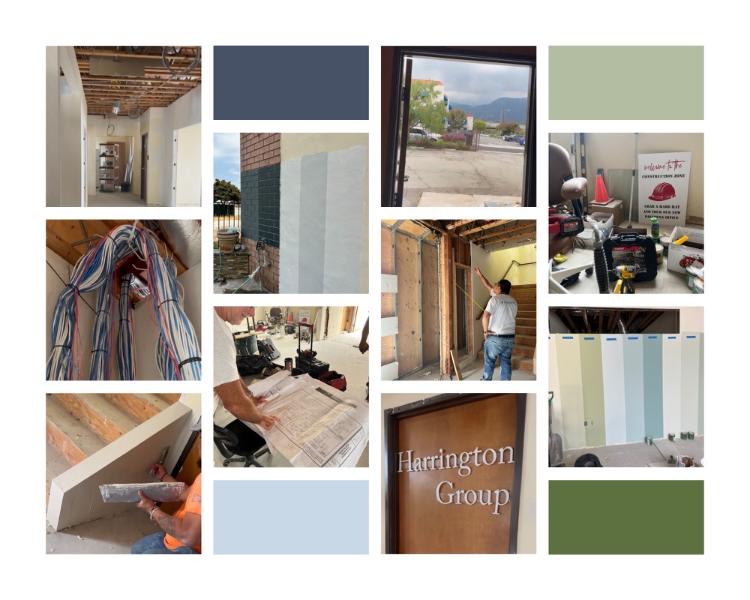

As you may have seen in some of our recent social media posts, construction is well underway at our Pasadena location. We are extremely excited to share some of Conspec’s developments with our readers, clients, and team updated on this process!

Some recent developments include the following….

Drywall is up and now the separate offices have officially taken form.

They are in the process of selecting the best possible interior colors for the space.

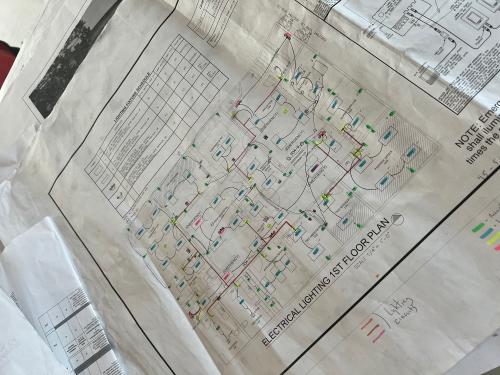

Electrical work is being completed, including all ethernet and alarm wiring for the best office experience. In these last few weeks alone, there’s been over 5 miles of cables installed.

The team works to complete the stairs by skim coating the sides.

Externally, the Conspec Team is also working to find the best color palette.

Additionally, the team troubleshoots the framing of the all glass entrance and works to waterproof it.

A main component of this process is restoring dated construction and bringing it up to code in 2022.

Continue on this journey with us through our social media platforms and blog where we will continue to update!

Father’s Day is right around the corner, on June 19th! Today, we want to share some fun ways to celebrate the Father figure in your life. These ideas vary in price, length, etc. but are all a sure way to make someone feel special. We hope these ideas help you find the perfect way to spend some quality time with any Dad you love.

Spa Day: Pamper the man that works so hard. Spa services are customizable to any Father’s needs. This activity could be so much fun to do together or given as a gift in the form of a gift card or certificate. It is even possible to do a budget-friendly take on the spa day in your own home!

Eat dinner together: Whether you make Dad’s favorite dish or your own, a home cooked meal is always appreciated. If money and time allow, going out for dinner at Dad’s favorite spot can be a great option as well.

Go out to your favorite bar: This activity is a great way to get out, have some fun, and open the door to some great conversation. Picking a place that you really enjoy is

Watch and/or attend a sporting event: Take your old man out to the ball game, MLB teams are in season right now, with a few games on Father’s Day. In addition to this, Hockey, NASCAR, and the MLS can provide some epic entertainment this time of year! Need something more cost effective? Consider making time to watch Dad’s favorite team together at home and make a day out of it. Another fun way to watch might be at a great sports bar or restaurant.

Go to a car show: A car show is yet another ropportunity to bond over common interests and just have a great time together. This is perfect for the whole family.

Plan a camping trip: This can happen in the backyard, at a national park, in an RV, in a more glam setting, down the street, or hours away. Consider picking a sentimental place to really tug Dad’s heartstrings. The ride to a camping trip can be another great bonding opportunity as well.

Spark up some competition: Anything from chess to cornhole to golf will do. These types of activities are a sure way to make some memories with Dad.

Head to an amusement park: Amusement parks are always fun; a great place to feel like a kid again and forget all the cares in the world. This is sure to be a hit for the dad who seeks a good thrill or just really loves to have some fun. Local theme parks vary in size and attraction types, making it even easier to find the right place for Dad.

Get Outdoors: A hike, walk in the park, or a bike ride can be a great way to get some good exercise, have some fun, and spend some quality time with loved ones. Not to mention most of these activities are free.

A good old fashioned gift: A gift of any price is bound to warm Dad’s heart. Any gift paired with a thoughtful card is a sure way to show appreciation. Unsure what to buy? Gift guides can be helpful resources in this case, we have some listed below:

https://www.uncommongoods.com/gifts/fathers-day-gifts/fathers-day-gifts?p=1&s=seven_day_sales%20desc&gclid=CjwKCAjwnZaVBhA6EiwAVVyv9Kvm-WUPwMRqa4gsPN95J7GpF9ZuK1MrhnSllSkCsZqcVXM65bKBMhoCZuoQAvD_BwE

https://www.macys.com/s/fathers-day-gift-guide/

As a nonprofit CPA, we at Harrington Group love to highlight local nonprofits dedicated to serving our communities. This past month included National Rescue Dog Day (May 20th) aimed at bringing awareness to animal adoption. So why not take the opportunity to share some nonprofit organizations that are dedicated to this special cause. The following nonprofits are based in our home cities of Pasadena and Oakland, California, where our offices are located. We hope that you are able to contribute to them in some way, even if that's just by spreading awareness! If you aren't looking to adopt an animal, it's possible that someone you know is ready for this exciting prospect. Share the following organizations!

Pasadena:

Lifeline For Pets: This group focuses on making a positive impact on the life of service animals. Lifeline for Pets rescues these animals from neglectful situations, helps place them in carefully screened family’s homes, and assists pet owners struggling with veterinary bills.

https://www.lifelineforpets.org

Pasadena Humane Society: This past year, this organization helped almost 40,000 animals find their forever home. Additionally, this branch of the Humane Society is helping the community care for and keep their pets by offering free and affordable spays, neuters, and vaccines. Their facility also features a pet food bank and an animal support call center.

https://pasadenahumane.org/about/who-we-are/#about-us-link

Mobility Service Dogs : This non-profit is dedicated to offering assistance to the mobility-impaired community. Mobility Service Dogs focuses on providing a user-friendly pathway for this community to find the right service dog for their lifestyle and needs.

https://mobilitydog.org/mission-vision-core-values

Oakland:

Muttville: This Oakland-based organization is dedicated to assisting older dogs in finding their forever homes. Muttville aims to show that many of these senior dogs have wonderful personalities, good health, and much love to share regardless of their age.

https://muttville.org

Berkeley Humane Society: This society is dedicated to helping provide care for dogs and cats in the East Bay. They engage the community through service opportunities.

https://berkeleyhumane.org

Rocket Dog Rescue: This rescue is dedicating their time to dog breeds often seen as aggressive that are commonly overlooked. Rocket Dog Rescue places non-aggressive dogs into temporary foster homes that focus on socialization, health needs, and improving behavioral conditions which would otherwise limit their adoptability. With their volunteer network, online adoption page, weekend adoption fairs, and neighborhood poster campaign they are able to seek permanent homes for these animals.

https://www.rocketdogrescue.org

Hopalong Animal Rescue: This Second Chance Animal Rescue has a mission to eliminate the euthanasia of adoptable animals throughout Northern California. Since the non-profit was founded in 1993, they have collectively saved over 24,000 animals by placing them in carefully selected, forever homes. In addition to providing care for the animals, they also advocate for the pets in local schools by educating students on spay/neuter services, animal advocacy, and humane education.

https://www.hopalong.org/about/

In the spirit of the season, maybe consider fostering or adopting pets within your community. Another great way to join the cause is by volunteering or donating to these wonderful non-profits.

It’s that time of year again, summertime is making its way to center stage and many of us are gearing up for a vacay. We work hard all year and hard work deserves a reward – but what if we don’t want to blow so much of the money we’ve been working hard to earn? Although budget isn’t a concern for every individual or family looking to vacation, it is most certainly a concern for much of the population. Without strategic planning, vacations can be very expensive, and prices are only rising year by year.

So, how can you take a solo vacay, a couple’s trip or a family vacay this summer without breaking the bank? We have some ideas for you!

1. Camping or Backpacking Trip

I don’t know about you but when I was growing up my family couldn’t afford many elaborate or costly vacations. Our go-to was always camping. Campsites are cheap if you’re into tent sleeping but you can also rent an RV or a cabin (if you want to price up). You can extend the stay for a week or more since lodging is so reasonably priced and therefore get a longer break from reality. You can (and probably should) pack up a bunch of food for the week – saving you on expensive restaurant meals which tend to add up quickly. Depending on the location you choose to camp, there can be plenty of activities to entertain a range of ages: bicycling, hiking, lake activities, beach activities, sports, board games, reading and so much more.

2. Beach Vacation

Visiting the beach is a great way to take advantage of what nature has to offer. Whether you camp near a beach or stay at a reasonably priced Air Bnb or Hotel – the beach has plenty of activities to offer. You can pack up some food in a cooler, grab some umbrellas and chairs, grab some supplies and head out for the day. Between sun tanning, playing in the water, building sandcastles, playing beach volleyball, frisbee, surfing, boogie boarding, paddle boarding, reading or any other time passing activity that attracts your attention – who could be bored at the beach?! To avoid peak costs, you can choose a beach in a less popular area where lodging is more reasonably priced. You can also choose weekdays when less people are booking.

3. Stay-cation

This may not sound exciting at first thought, but a staycation can be a lot of fun and it can save you cost on lodging, in order to allow you to spend more of your budget on activities and experiences. Decide the dates that you would like your staycation to span between and block them off of your calendar. You can decide to stay at home for this time (free lodging) or you could see if a nearby friend or family member would let you stay with them.

Tour your own city in a way that you don’t normally do. Take advantage of surrounding museums, zoos, beaches, arcades, comedy shows, movie theaters, escape rooms, performances, unique experiences, restaurants and more! You can pack multiple experiences into one day – just like a vacation. If it’s an option in your area, consider catching the train to an area with several options for entertainment and spend the day experiencing different options in that area. Incorporate days that include more down time such as laying on the beach or reading at a park, going to the movie theater or having a picnic. Plan to eat the way you would on vacation, so that you aren’t worrying about getting groceries and cooking every meal (or plan meals in advance and have them prepped). Do whatever you need to do in order to fully immerse yourself in the staycation, ensuring that you still get to unplug and go into vacation mode even though you are so close to home or actually at home!

4. Mid-week Vacation

Taking a mid-week vacation is a pretty simple way to save money. Most people want to vacation during the weekend (or at least have a weekend included in their longer trip). That means prices for lodging and even experiences or performances are cheaper during the week. There will also be less crowds and for some of us that means more relaxation!

5. Get a last-minute deal

Last minute deals are a great way to snag a discount on a hotel stay. This may be a stressful option for someone who likes to plan ahead but if you can make it work, the discount will work in your favor. Online travel hubs like Groupon and Expedia pride themselves on offering great last-minute vacation deals, while HotelTonight allows you to score major deals on a room by booking the day of!

6. Home Swap

Do you know any other families who would be interested in a staycation? Or any families who live out of town and would be interested in swapping homes with you for the week? It’s a little out of the ordinary but a home swap would be another great option for saving on expensive lodging. Just make sure you leave their home as you found it or better!

7. Look For Free Events

Wherever you end up on your vacation, there are bound to be free events in the area. Do some research to see if you can find some entertainment, such as a free concert at a bar, a local food festival, a block party or even a bar that has karaoke. It’s important to have an open mind and remember that it’s not always what you’re doing but who you’re doing it with that matters, as well as your attitude. Take advantage of whatever you find.

8. Plan Meals and Snacks

You don’t need to do this for EVERY vacation meal but planning ahead and packing food can save you some major dollars when it comes to feeding yourself and/or your family. Purchasing every meal and snack on vacation really adds up. If you’re driving somewhere, bring a cooler filled with prepared food. Throw power bars, trail mix and any handheld snacks in your luggage. Take this tip to whatever length benefits you, whether it’s just a few snacks or enough food to span your entire trip (such as if you’re camping).

We hope these tips help you save some money this summer or on any future vacation. Just because you’re working within a budget, doesn’t mean you can’t take time off to enjoy yourself. It’s not always about how much money you have, it’s about how you manage it. Enjoy!

About twenty two years ago, April was selected as National Financial Literacy month by the Jump$tart Coalition for Personal Financial Literacy. This group primarily focuses on promoting the financial curriculum to young people.

Financial literacy and knowledge is essential to comprehending how to save, earn, borrow, invest, and protect your earnings effectively. As a parent or mentor, you should be teaching financial literacy at a young age. When children and young people are taught about finances, they are better equipped to avoid bankruptcy and financial debt in the future.

With the recent pandemic, young people need this guidance more than ever. Life is so clearly uncertain, and it's essential to be prepared for a rainy day. According to the Financial Industry Regulatory Authority, 66% of Americans are financially illiterate. It's important to teach young people to be prepared for the long term and to work on their spending habits. Maybe you already have the intention to share such knowledge with loved ones, but feel overwhelmed by such a vast subject matter.

Regardless of how you feel, here are some great tips to share with young people in your life:

Create a budget: Try using an Excel sheet, Google sheet, an app, or old school paper and pen to track monthly expenses, both necessary and unnecessary, versus monthly income.

Pay yourself first: After choosing a savings goal, pay money toward this goal with every paycheck before spending money anywhere else. This strategy forces you to make sure bills and debts never get out of hand. Additionally, it holds you accountable on your goals.

Begin building credit: It's essential to help folks build credit, try helping those who are of age open a credit card. The third most crucial way to increase your credit score is the length of your credit history. This is why we see the majority of folks with near perfect or perfect credit scores being Gen X or Baby Boomers. In addition to this, a credit card is a great way for a young person to learn financial responsibility.

Get your credit report and score: Every year, consumers are able to seek a credit report, free of charge from Experian, Equifax, and TransUnion. This is a great way to monitor any inconsistencies and you can do it three times a year, once from each company.

Manage Debt: Minimize spending and maximize repayments. Consider doing this in a meticulous fashion, by paying off debts with the highest interest rates first. There is even debt-counseling for those struggling more than others.

Think Future forward: Take advantage of your employer’s 401(k) retirement savings account by inputting the maximum amount, especially if a match program is offered. Regardless of the situation, it is a great idea to open up an individual retirement account (IRA). If possible, begin seeking advice from financial professionals about your future.

With these tips, some knowledge on common financial terminology, and whatever life experience you have to offer, the young people in your life are being set up for financial success. Have these conversations today to help the future of the young people in your life.

April is speeding by and Earth Day is right around the corner! In addition to admiring the beauty that this world is, consider finding ways to further protect our Earth this year. In this blog we’ll give some simple ideas you can implement into your office and your home to celebrate Earth Day 2022.

In office:

How can you as a business owner or supervisor improve environmental initiatives in your office? Laying off the thermostat, going paperless with all office correspondence, making recycling easily accessible, and maximizing your use of natural light can all add up quickly to reduce your office’s carbon footprint.

While ‘National Walk to Work Day’ is generally observed on the first Friday of April, there is potential to incentivize commuting to work in a greener way all month long. Additionally, if there aren't a ton of local employees, maybe consider incentivizing carpooling to work. You can host a contest to see which team members walk or carpool to the office the most.

Keep these contests going all year long, challenging your team to reduce their use of plastic utensils, plastic cups, plastic bags, etc. Incentivize things like free coffee and gift cards. If this sounds like something you personally might not have time to keep track of, a sustainability team might be of some interest. Consider putting a group together to run monthly green challenges. This team can also initiate a power-down rule for the end of every shift, and anyone who doesn’t follow can either receive a note or put a dollar in a jar.

Source: https://www.techrepublic.com/article/going-green-10-ways-to-make-your-office-more-eco-friendly-and-efficient/

In home:

When shopping, bring out your bags and turn down the paper and plastic, look for products with less packaging, buy second hand, and only buy what you’ll actually use. Consider switching to a water filter and going away from plastic bottles when possible. Composting has also become more accessible, with pickup services all around the nation for affordable prices. Donating used goods is always appreciated and creates jobs as well.

Source:

https://www.usatoday.com/story/money/2019/06/17/climate-change-30-ways-to-make-your-life-more-environmentally-friendly/39366589/

Why is Earth Day important?

April 22nd, 1970 marks the start of the modern day environmental movement, what we now annually commemorate as Earth Day. This movement marks the consciousness of issues of consumption in the nation. The idea came to be a junior senator from Wisconsin, Gaylord Nelson. By 1990, Earth Day had gone global. The small, everyday choices you make in the office and at home can significantly help our planet. And can one day, help non-profits gain more credibility on a larger scale.

| Free forum by Nabble | Edit this page |