Harrington Group Blog

Happy New Year from all of us at Harrington Group!

We wish you a bountiful 2018, full of joy and opportunity.

Cheers!

We wish you a bountiful 2018, full of joy and opportunity.

Cheers!

We are never more proud to be CPA to over 250 non-profit organizations than in this, the season of giving. It’s a time of reflection on what really matters and what is missing the lives of so many men, women, children, and animals in the world. With good intentions running high and generosity in just about everyone’s spirit, we thought it was the perfect time to make a list (and check it twice) of ways you can provide help to those that need it a little extra holiday cheer.

1. Collect cans of food and donate them to a food bank.

2. Gather up your old coats and donate them to Goodwill or a homeless shelter.

3. Buy books for strangers. Put them in free libraries around town with notes inside.

4. Give an unexpected generous tip to make someone’s day.

5. Bake (or buy) some holiday cookies and bring them to a children’s center. Maybe buy plain cookies and let the kids decorate them!

6. Sign up for a holiday 5K for which the money goes to a good cause.

7. Donate possessions you no longer need to the Salvation Army.

8. Bring a box of toys to a children’s hospital.

9. Donate blood and save a life.

10. Bring some blankets, pet food or pet toys to the animal shelter.

Remember, all of these things are appreciated a little bit more at this time of year, but we can always be helping to end hunger, provide health care, and save animals. Keep giving when you are able, and check back regularly to see how you can serve. We’re always updating ideas on the blog and through Facebook and Instagram!

Harrington Group and everyone we work with thanks you from the bottom of our hearts.

While we strongly believe the saying “behind every successful business is a great accountant,” we recognize that every business’ road to success is different. One thing remains the same, however, and that is a good, preliminary budgeting plan will inevitably set your business up for a much smoother ride than trying to play things by ear.

We put together a little list of universal budgeting tips to be applied at any time, to businesses of all shapes and sizes, making your (and your CPA’s) life easier!

1. List your set expenses

Make a list or chart of all your recurring expenses, along with their costs and due dates so you know what’s coming and are never late with payment. This includes things like rent, utilities, payroll, insurance, and any materials/inventory your business might require.

2. Put debt repayment at the top of your list

After you’ve taken care of the payments that keep your business running turn directly to any and all debt you have regarding your business. These payments should come before any extra expenses so as to stay ahead of excessive interest charges and keep you on track to pay off all loans and credit cards. The sooner you can stop making those payments the sooner those funds can go toward exciting new facets of your business!

3. Save for hidden/unexpected costs

It’s so important to set aside a percentage of your business’ earnings for the inevitable surprise fees and expenses that will pop up through the course of business.

4. Think big, save big

Always, as a general rule of thumb, overestimate the cost of things. That way when something ends up costing less you can relocate those funds to other areas, but if the price is inflated your budget is padded to accommodate.

5. Constantly revisit your budget

Update your spending and earnings as you go and keep a close eye on your financial standing/patterns. Don’t be afraid to move things around as you find your rhythm, just remember that adjusting one thing in your budget very likely affects multiple other areas, so adjust accordingly.

Implementing these practices as soon as possible will make your business journey so much smoother, and your CPA proud! What are some budgeting habits you’ve found to be imperative to your business’ success?

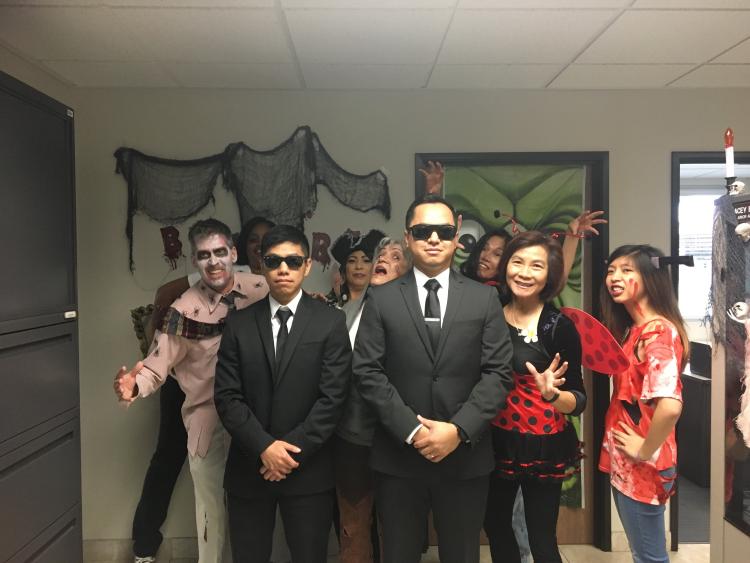

At Harrington Group we are fortunate to work with a vast network of wonderful organizations that are making a difference in the world. Let’s take a moment to turn the spotlight on one of them (and share this hilariously adorable photo of their accounting department on Halloween with the MIB Audit team – that’s us!) and learn a little bit about what they do and why it’s so deeply important

Today Harrington Group is proud to feature McKinley Children’s Center.

Born from one couple who generously opened their doors to homeless, orphaned, or abused children over 100 years ago, the program has grown immensely throughout American history. It has expanded in its offerings but never wavered from its mission: to compassionately transform “the lives of youth and families through innovative education, counseling, and social services; inspiring hope to achieve success.”

Today McKinley Children’s Center offers a variety of services to help underserved youth find their way in the world. It’s a real-life Wizard of OZ foundation built on providing the essentials: a brain, a heart, a home, and courage.

The schooling program offers small, focused classes with a unique, individualized approach to learning for each student enrolled. They work hard to provide counseling and mentoring to any person (or family) in need in order to set a foundation for success, both academically and emotionally. Mental Health programs are offered in wide variety, designed to be available for assistance in all stages and hurdles of life, and the foster care and adoptions program flourishes within a circuit board lit up with families and community members eager to help. Most importantly Mckinley Children’s Center works hardest to give all those who join them a chance to experience the world with confidence and joy.

Want to get involved? Learn how you can make a difference from volunteering to donations here!

Today Harrington Group is proud to feature McKinley Children’s Center.

Born from one couple who generously opened their doors to homeless, orphaned, or abused children over 100 years ago, the program has grown immensely throughout American history. It has expanded in its offerings but never wavered from its mission: to compassionately transform “the lives of youth and families through innovative education, counseling, and social services; inspiring hope to achieve success.”

Today McKinley Children’s Center offers a variety of services to help underserved youth find their way in the world. It’s a real-life Wizard of OZ foundation built on providing the essentials: a brain, a heart, a home, and courage.

The schooling program offers small, focused classes with a unique, individualized approach to learning for each student enrolled. They work hard to provide counseling and mentoring to any person (or family) in need in order to set a foundation for success, both academically and emotionally. Mental Health programs are offered in wide variety, designed to be available for assistance in all stages and hurdles of life, and the foster care and adoptions program flourishes within a circuit board lit up with families and community members eager to help. Most importantly Mckinley Children’s Center works hardest to give all those who join them a chance to experience the world with confidence and joy.

Want to get involved? Learn how you can make a difference from volunteering to donations here!

November is upon us, and while many people maintain the old standby rule that there is no Christmas music until Thanksgiving, it’s safe to say that the majority of us are pretty much decking the halls the day after Halloween. No matter which camp you’re a part of we have a few tips we recommend implementing right at the beginning of the season in order to make it the best one yet!

Remember: this is a season of giving. Find a non-profit that you care about and volunteer some time or donate some resources – this is known one of the jolliest times of the year but for many it’s one of the hardest. Be it an animal shelter, an after school program, a kitchen, or simply bringing a toy to a donation bin, you will feel great knowing that you contributed to someone else’s holiday season experience.

Try: setting a budget. We are entering the biggest spending season of the year, which causes stress in relationships, businesses, and families. Consider laying out a rough schedule of the biggest money-sucks in your near future; parties (friends and work), weddings, family gatherings, and nights out – all of these things usually require purchasing food and/or gifts. Make a plan and decide on a reasonable budget so that you don’t end up cringing at your bank statement come January 2nd.

Don’t Forget: if you’re traveling, book it now! The best deals are on and things will only get more expensive – honor your budget goals and plan ahead!

Most Importantly: have fun. For many people the stress of the holidays overwhelms the joy…don’t let it! Focus on the meaning of the season, surround yourself with people you love, do some good for others, and stay the course of what makes the holidays happy, whatever that may mean for you!

So you hit the pumpkin patch. Hard. And soon the trick-or-treaters will have come and gone and you’ll be left with a dozen pumpkins of various shapes and sizes that you’re not really sure how to dispose of responsibly…until now. We love giving back to our earth and these three methods of pumpkin recycling do just that – waste not, want not!

1. Compost. It’s the easiest thing to do with your carved jack-o-lanterns that are maybe a little worse for the wear thanks to any lingering October heat. They make great food for your garden, just throw ‘em in there, chopped or whole, and let nature do its thing! If you’re a city dweller seek out a community garden that will likely be grateful for the donated organic matter!

2. Donate them to a farm or zoo for animal feed. Pumpkin is wonderfully healthy for human and animals (if you’re interested in cooking yours find a recipe for pumpkin puree here, then turn it into something delicious for you…or your dog!) and there are farms, petting zoos, and regular zoos that happily will accept yours for good animal eatin’.

3. Ready for the cutest post-Halloween craft ever? Make a bird feeder! Like we said, pumpkin is great for animals, and those cute little pumpkins that have adorned your table top for the last month make the sweetest bird attractions, whether you live in an apartment or a home with a yard. Cut a hole in the side and scoop out the guts, and then fill the cavity with some birdseed – they can eat the seed and the pumpkin! Lastly, tie some twine around the stem and hang it outside.

Interested in giving back even more? There are loads of Halloween costume and candy donations available all over the US, do a quick search in your area to see how you can help!

1. Color changes. Whether it’s trees, wardrobe, or the general aesthetic at the grocery store, you can’t help but feel inspired and a little bit warmed by the season change.

2. Pumpkin Spice. You either enjoy it, or you enjoy making fun of people who enjoy it.

3. Sales galore! Summer merch is massively discounted, and back-to-school sales have gotten even better now that school is actually back in session. Even airfare is cheaper in the fall! Start. Saving.

4. No more summer crowds. If you live somewhere remotely touristy you get your city back for a small window of time before the holidays. Breathe deeply while you can.

5. Changes in food flavors. Suddenly soups and braises become readily available and produce has switched from bright, light options like berries and asparagus to heartier, moody varieties like squashes and pomegranate.

6. Changes in drink flavors. Wine tendencies switch from white to red; spirits favor a darker medium like bourbon and spiced liqueurs. Variety is good for the soul, folks.

7. There is no lack of things to do. You thought summer weekends were busy, but fall offers almost more events and incentives to get out of the house and have some fun! Pumpkin patches, apple orchards, haunted houses, and just the general desire to stroll through the park with a hot beverage in hand.

8. Cozy season is in full effect. Yes, it gets dark earlier but it almost feels like permission to snug up on the couch with a good book or movie rather than going out and spending money. Just set the slow cooker in the morning and let all social pressures fall by the wayside!

9. Grilled cheese and tomato soup. Enough said.

10. Halloween is really fun. Jack-o-lanterns, costumes, fun décor, scary movies…and if none of those things float your boat there is always the discounted bulk candy to consider.

Before you know it Autumn is waning and the holidays are rapidly approaching, so remember to live in the moment before it passes you by!

Maybe you’re that lucky person who loves the heat and lives for the summer. Maybe you love sweating without moving. Maybe you crave the challenge of not being able to properly sit down in the car for the first five minutes of your drive because the seat is too hot and you’re trying not to let the belt fully touch your skin. If you’re that person then we salute you. The rest of us will be over here gazing at the distant horizon that promises cozy evenings, changing leaves, and a happy reprieve from the sweltering days of summer.

Fall, we see you, and we can’t wait.

Until everything turns to pumpkin spice, however, we still have some summer heat to get through. The last heat wave of the season is always the most brutal, even for sunshine lovers, so we’ve put together a little survival list to get you through until autumn finally arrives.

1. Cold showers. The best part of coming home after inevitably sweating like crazy – even if it was just the walk from the car to your door – is hopping into a nice, cool shower and rinsing it all away. Bonus points if you take your ice-cold beer in with you (shower beers are a thing and they’re great).

2. Since you can’t stay in the shower forever we recommend soaking a bandana with cool water and sticking it in the freezer for an hour. Just when you feel like you’re overheating pull that sucker out and wrap it around your neck or lay it across your forehead. Instant relief! This is also great for your pup – remember, if you’re overheating so are they!

3. Flavored ice cubes. It’s important to stay super hydrated in the heat, so make drinking water more fun by freezing berries, lemon, or cucumber bits in your ice cubes. It gives your water a nice, subtle flavor while keeping it cold and not adding a bunch of sugar and calories.

4. Get out of town. The heat is always more tolerable if you’re doing something fun. Even if you’re just escaping to the next town over, find a way to take a little getaway and feel like you’re treating yourself. Suddenly the sun isn’t the enemy!

5. Get some culture. Museums are notoriously super air conditioned, and often have free or discounted days. Get a hit of history or find inspiration while staying cool for a couple of hours.

6. When in doubt…ice cream. I don’t think we need to say much more.

At Harrington Group we are big fans of to-do lists. They set the tone for a project, and when minds wander or tasks get out of hand they bring us back to what is truly important to the overall goal. But to-do lists don’t have to be all work and no play; in fact some of the best are exactly the opposite!

With the last official month of summer looming we recommend making the most of it by – you guessed it – making a to-do list of all the quintessential activities you haven’t had time to get to yet. Keep it posted somewhere you will be able to see it regularly so it can remind you to prioritize some fun with the rest of the madness that the world throws into our day-to-day.

Just to get the ball rolling we have a few suggestions when it comes to making the last month of summer the best it can be:

• Take a trip. Big or small, long or short, give yourself the gift of a getaway to recharge your batteries and soak up some summer vibes.

• Unplug. Take a day away from technology, be it outdoors or simply to dive into a good book – make it count. Invite friends to do the same and have an unplugged dinner party. Play cards and sip cocktails. Make something. Let your brain remember what it feels like not to rely on technology for 24 hours.

• Go to the fair. Or a festival. Or an outdoor movie. Do something that makes you feel like a kid again! Eat all the fried food and ice cream and don’t feel bad about it for even a minute.

• Dine al fresco. This may not be an activity limited to summertime but it does feel the most luxurious during the months in which the sun lingers in the sky. Enjoy golden hour with someone you love and seasonal food and drink to compliment the atmosphere.

• Hit the farmer’s market. Most of them are year round but there is no produce as bright and delightful as summer produce! Get your fill of sun-soaked veggies and berries while you still can.

• Find water. Summer is best served with toes dipped in some body of water, be it ocean or river or lake. Pack a picnic (or at least a cooler) and enjoy the reprieve from the heat while feeling like true summer royalty.

Let’s make August count! Which activities are at the top of your to-do list?

The key to a good company is a good team. You can have all the other pieces in place but if your crew doesn’t gel success will be imminently delayed in comparison to a team that is excited and motivated to work together.

So how do you bond your people? Give them the chance! Setting up an extracurricular activity is so important for letting personalities come together and reinforcing positive connections, as well as showing the squad a different way of working together (which can later be applied in a new way at the office). When arranging your next team building exercises look for these important components:

1. Get out of the office.

By separating the team from the workspace they are allowed to let their walls down a little bit and relax around each other. No one likes an uptight get together!

2. Make it something constructive.

It’s fun to go bowling or out to a restaurant, but by making the chosen activity something productive you encourage the team to work together in a way they wouldn’t in the office. Consider volunteering at a homeless kitchen and cooking together, or a team sport that everyone can be involved in.

3. Have fun.

Make sure you keep it light and low-pressure so everyone is able to get comfortable with each other. Keep competition friendly and conversation flowing.

4. Treat the team.

Whatever you end up doing, make sure your group feels valued. Show them that you appreciate their hard work and reward them with a positive experience!

| Free forum by Nabble | Edit this page |